Online banking has seen an incredible boom in the last decade, including the massive uptake of mobile banking. While mobile banking was originally performed through SMS then through mobile browsers, with mobile banking becoming far more commonplace in society, banking apps have become increasingly sophisticated and the security to protect customers has had to evolve accordingly. Financial institutions of all kinds, including banks, building societies, credit unions, credit card companies, remittance companies, brokerage firms, non-bank lenders and money transfer enterprises can benefit enormously from mobile banking, as can their clients.

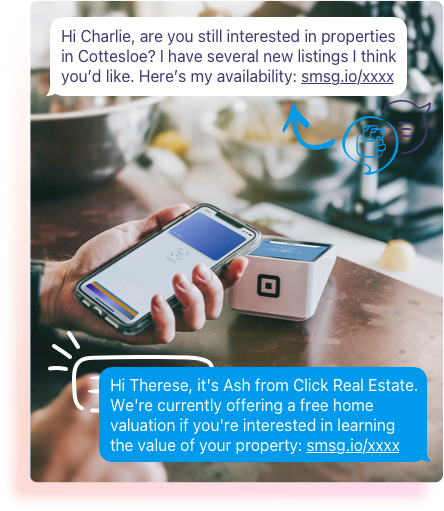

While SMS is lesser used for performing banking transactions now, there are various SMS banking solutions that are specifically customised for use by the finance and banking industry. The advantages of using SMS for banking purposes include enhanced communication with regards to speed, cost effectiveness, reliability, and unobtrusive messaging. Open and response rates for text messaging are far superior to that for email, which in turn is preferred over traditional mail and voice-to-voice calling for ease of use.

Customers prefer reliable information regarding their financial transactions. Invest in a banking SMS gateway for your financial institution to amplify the satisfaction of your clients and hence to maximise your profitability.

SMS banking solutions can be used in the following ways:

Customers prefer reliable information regarding their financial transactions. Invest in a banking SMS gateway for your financial institution to amplify the satisfaction of your clients and hence to maximise your profitability.